-

Fund Type : An Open Ended Liquid Scheme. A Relatively Low Interest Rate Risk and Moderate Credit Risk.Entry Load : NilDate of Allotment : July 16, 2008

-

Benchmark :Tier 1: CRISIL Liquid Debt A-I IndexExit Load :

Investor exit upon Subscription Exit Load(as a % of redemption proceeds) 1 day 0.0070% 2 days 0.0065% 3 days 0.0060% 4 days 0.0055% 5 days 0.0050% 6 days 0.0045% 7 days or more Nil

Investment Objective

The Scheme seeks to deliver reasonable market related returns with lower risk and higher liquidity through portfolio of debt and money market instruments. The Scheme is not providing any assured or guaranteed returns.There is no assurance that the investment objective of the scheme will be achieved.

Fund Manager

-

Mr. Mithraem Bharucha

BMS and MBA

See detail

See detail

Fund Highlights

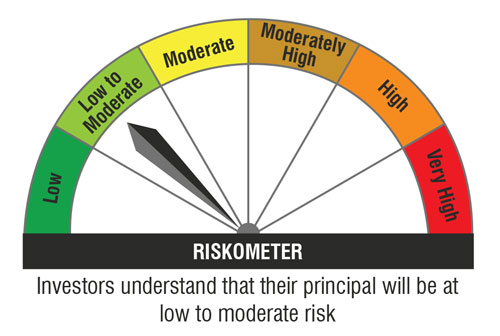

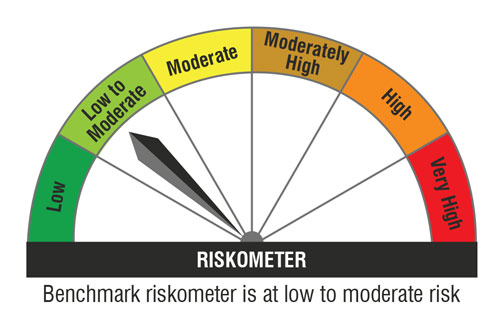

Riskometer

| Potential Risk Class Matrix | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Credit Risk | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) | ||||||

| Interest rate Risk | |||||||||

| Relatively Low (Class I) | B-I | ||||||||

| Moderate (Class II) | |||||||||

| Relatively High (Class III) | |||||||||

Top 10 Portfolio Holdings

Credit Profile

Asset Allocation

Performance(Regular Plan - Growth Option & Direct Plan - Growth Option)

| Current Value of Standard Investment of Rs 10000 in the | |||||||

|---|---|---|---|---|---|---|---|

| Period | NAV Per Unit (Rs.) | Scheme | Benchmark | Additional Benchmark Returns | Schemes | Benchmarkrs | Additional Benchmark |

| 6 days | NA | NA | NA | NA | NA | NA | NA |

| 7 days | 3106.0971 | 5.99 % | 5.77 % | 3.57 % | 10011 | 10011 | 10007 |

| 15 days | 3102.6500 | 5.50 % | 5.35 % | 1.80 % | 10022 | 10021 | 10007 |

| 30 days | 3095.6441 | 5.33 % | 5.20 % | 1.59 % | 10044 | 10043 | 10013 |

| 1 yrs | 2922.0445 | 6.42 % | 6.26 % | 5.75 % | 10642 | 10626 | 10575 |

| 3 yrs | 3065.2253 | 5.75 % | 5.59 % | 3.48 % | 10142 | 10138 | 10087 |

| 5 yrs | 2336.5033 | 5.88 % | 5.89 % | 5.64 % | 13309 | 13313 | 13159 |

| 10 yrs | 1716.1480 | 6.12 % | 6.10 % | 6.12 % | 18120 | 18083 | 18115 |

| Since inception | 1000.0000 | 6.67 % | 6.78 % | 6.35 % | 31097 | 31654 | 29457 |

IDCW History

| CLICK HERE TO VIEW THE IDCW HISTORY |