Data as on 04th feb 2025

Bank Of India Multi Asset Allocation Fund

-

Fund Type : An open ended scheme investing in Equity, Debt and Gold ETFEntry Load : NilDate of Allotment : Feb 28, 2024

-

Benchmark :37.50% of Nifty 500 TRI + 50% of Nifty Composite Debt Index + 12.50% of Domestic Prices of GoldExit Load :

Investment Objective

The investment objective of the scheme is to seek long term capital growth by predominantly investing in equity and equity related securities, debt and money market instruments and Gold ETF. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/ indicate any returns.

Fund Manager

Mr. Mithraem Bharucha

BMS and MBA

See detail

See detail

Mr. Nilesh Jethani

See detail

See detail

Fund Highlights

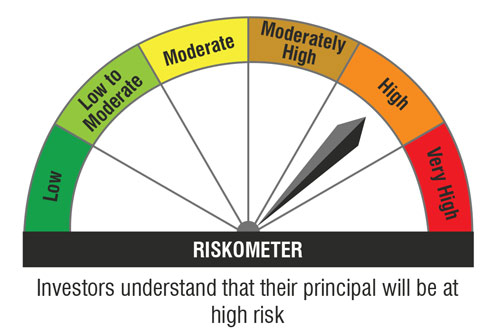

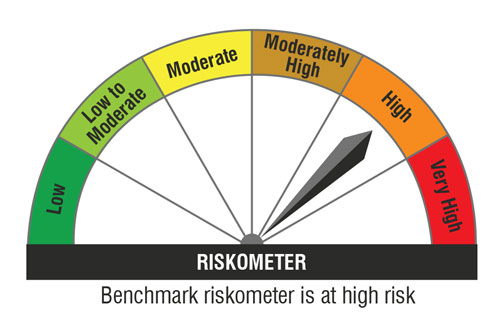

Riskometer

*Investor should consult their financial advisor if in doubt about whether the product is suitable for them

The above Benchmark Riskometer is based on the portfolio as on 31st January 2026.

Top 10 Portfolio Holdings

Sector Allocation

- Portfolio weight (%)

- Benchmark weight (%)

Fund Advantages

- Mix of 3: Equity, Debt and Gold

- Exposure to a mix of stocks, bonds, and other assets

- Minimum allocation of at least 10% each in all three asset classes (Equity, Debt and Gold)

- Portfolio building using a combination of top-down and bottom-up approach

- Taxation - offers indexation benefit

As per prevailing tax laws, subject to change. Please consult your tax advisor.

Allocation Strategy

- ( 0% to 10% ) - Units issued by REITs and InvITs

- ( 10% to 15% ) - Gold ETF

- ( 35% to 40% ) - Equity & Equity Related Instruments

- ( 45% to 55% ) - Debt and Money Market instruments

Performance(Regular Plan - Growth Option & Direct Plan - Growth Option)

| Current Value of Standard Investment of Rs 10000 in the | |||||||

|---|---|---|---|---|---|---|---|

| Period | NAV Per Unit (Rs.) | Scheme | Benchmark | Additional Benchmark Returns | Schemes | Benchmarkrs | Additional Benchmark |

| 1 yrs | 10.7229 | 14.79 % | 15.48 % | 8.97 % | 11479 | 11548 | 10897 |

| 3 yrs | NA | NA | NA | NA | NA | NA | NA |

| 5 yrs | NA | NA | NA | NA | NA | NA | NA |

| 10 yrs | NA | NA | NA | NA | NA | NA | NA |

| Since inception | 10.0000 | 11.39 % | 13.75 % | 8.99 % | 11139 | 11375 | 10899 |

IDCW History(Regular Plan- Annual IDCW)

| Record Date | IDCW (`/Unit) |

| 02-Feb-2021 | 0.23090000 |

| 02-Feb-2021 | 0.23090000 |

| 30-June-2021 | 0.30000000 |

| 30-June-2021 | 0.30000000 |

| CLICK HERE TO VIEW THE IDCW HISTORY |