Data as on 04th feb 2025

Bank Of India Mid & Small Cap Equity & Debt Fund

-

Fund Type : An Open Ended Hybrid Scheme investing predominantly in equity and equity related instrumentsEntry Load : NilDate of Allotment : July 20, 2016

-

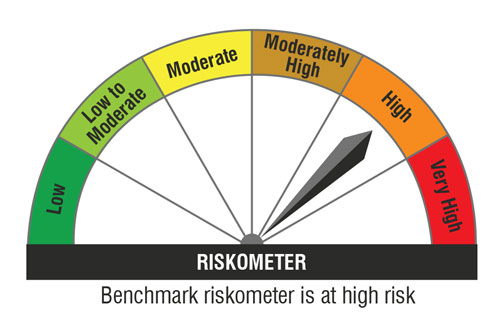

Benchmark :NIFTY MidSmallcap 400 Total Return Index (TRI): 70%; CRISIL Short Term Bond Index: 30%Exit Load :

Investment Objective

The scheme's objective is to provide capital appreciation and income distribution to investors from a portfolio constituting of mid and small cap equity and equity related securities as well as fixed income securities. However there can be no assurance that the income can be generated, regular or otherwise, or the investment objectives of the Scheme will be realized.

Fund Manager

-

Alok Singh

CFA and PGDBA from ICFAI Business School.

See detail

See detail

Fund Highlights

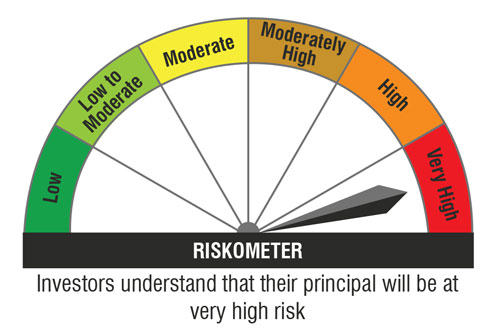

Riskometer

Top 10 Portfolio Holdings

Credit Profile

Asset Allocation

Performance(Regular Plan - Growth Option & Direct Plan - Growth Option)

| Current Value of Standard Investment of Rs 10000 in the | |||||||

|---|---|---|---|---|---|---|---|

| Period | NAV Per Unit (Rs.) | Scheme | Benchmark | Additional Benchmark Returns | Schemes | Benchmarkrs | Additional Benchmark |

| 1 yrs | 35.6100 | 6.12 % | 6.44 % | 8.97 % | 10612 | 10644 | 10897 |

| 3 yrs | 22.8400 | 18.28 % | 18.02 % | 14.08 % | 16546 | 16439 | 14848 |

| 5 yrs | 15.5900 | 19.35 % | 17.75 % | 14.52 % | 24240 | 22656 | 19714 |

| 10 yrs | NA | NA | NA | NA | NA | NA | NA |

| Since inception | 10.0000 | 14.95 % | 14.26 % | 13.38 % | 37790 | 35682 | 33141 |

IDCW History(Regular Plan- Regular IDCW)

| Record Date | IDCW (`/Unit) |

| 26-March-2018 | 0.75 |

| 29-July-2021 | 0.80 |

| CLICK HERE TO VIEW THE IDCW HISTORY |